Mastercard Credit Card Application | Apply for a Credit Card

Mastercard is a global financial services organization with its headquarters in the USA. Its primary business is to process financial transactions carried out with debit and credit cards issued by a wide range of banks and other financial institutions.

It acts as a payment settlement and clearing-house for digital transactions. In this write-up, we shall be giving you a guide on how the Mastercard Credit Card Application can be done.

Mastercard Credit Card Application

About Mastercard Credit Card Application

Mastercard is an organization that facilitates payments carried out with credit and debit cards between the banks of merchants and the issuing banks of the cards.

Mastercard is one of few payment networks that enjoy worldwide acceptability across multiple payment categories and connects consumers, financial institutions, businesses, merchants, governments in over 200 countries.

Mastercard works as a settlement network for the card issuers and charges a small portion of the transacted amount as the payment processing fee.

Also, the payments carried out through the Mastercard network are secured with an additional online security level. Below are the types of MasterCard;

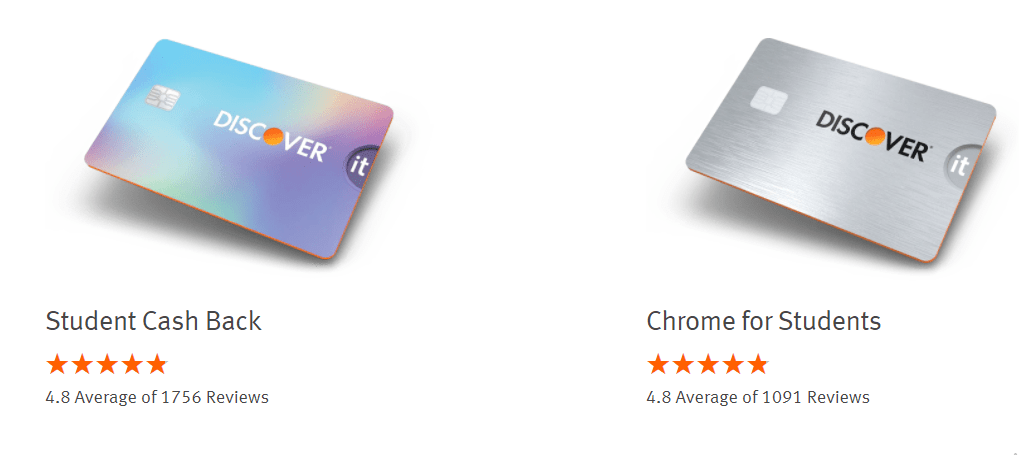

- Standard Mastercard

- Platinum Mastercard

- World Mastercard

Standard Mastercard

This is the best for everyday purchases including stores, online, and hotels.

Platinum Mastercard

These MasterCard cards enjoy worldwide acceptance and add to your experience of availing yourself the best of lifestyle services and choices.

World Mastercard

World Mastercard cards also offer worldwide acceptance and a host of attractive travel-specific and other category benefits.

The benefits offered by a MasterCard credit card will depend on the type of MasterCard credit card you have applied for. It is always recommended you get in touch with the bank in order to know more about the benefits offered by the MasterCard credit cards issued by them.

Benefits Of Using a Contactless MasterCard Credit Card Application?

Some benefits of using a contactless MasterCard credit card are:

- You do not have to fish for cash or coins or look for loose change while making a payment.

- The card never leaves your hand, hence making the whole payment experience more secure.

- It is easier to keep track of your expenses as it is to keep if you make payments through cash. You can always get hold of the mini statement which will provide you the details of all the transactions made by you.

- In places where you are required to make payments fast such as stadiums, movie halls, petrol pumps, etc. having a contactless credit card is an extremely suitable option as it saves you time.

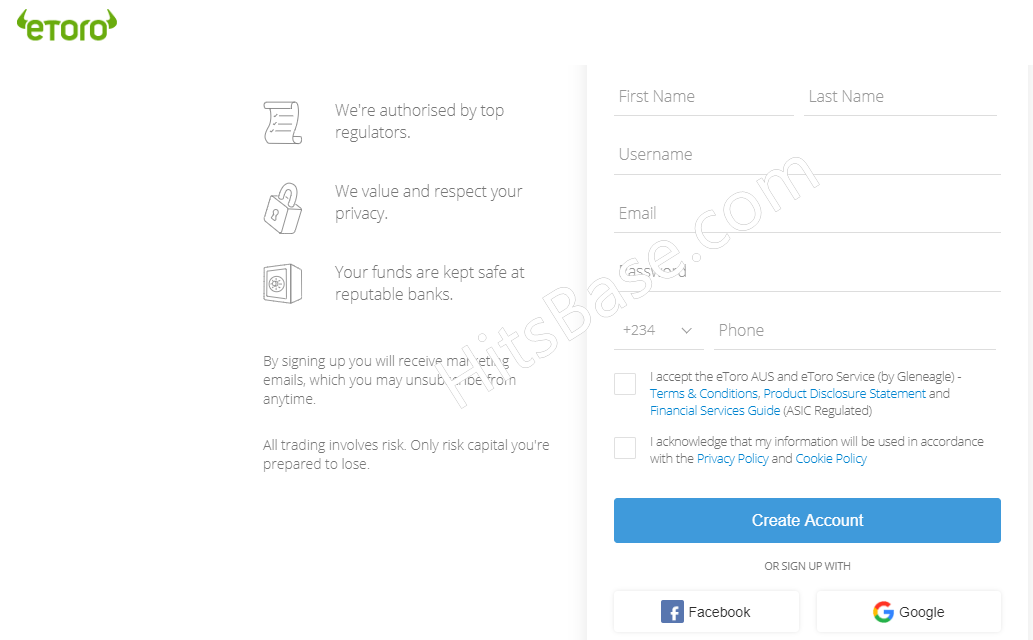

How to Apply for a Mastercard Credit Card?

For you to apply for a MasterCard credit card, you need to;

- Visit the Mastercard official website Here

- Then check out the credit cards that it is offering

- Click on the credit cards options

- Select the bank whose credit card you want to use.

Mastercard Credit Card Offers

Mastercard credit cards have different offers spread across diverse categories. For instance, the travel Mastercard credit cards offer attractive travel benefits in the form of special discounts and cashback on hotels and travel ticket bookings.

Similarly, dining credit cards have tempting offers at participating restaurants and online food ordering apps. Shopping cards offer multiple shopping benefits. Check out the entire list of the credit card offers that you can enjoy with Mastercard.

Difference between Mastercard Credit Card and Mastercard Debit Card

The primary differences between a Mastercard Credit Card and a Mastercard Debit Card are listed below;

- Mastercard credit card offers you a line of credit that can be availed with the card, a debit card doesn’t offer any credit but is linked to your current or savings account which gets debited.

- Mastercard credit cards generally offer you an interest-free period of 45-55 days depending on the transaction date with respect to the billing cycle and the issuing bank. Because there is no concept of credit in using a Mastercard debit card, there’s no interest-free period involved.

- Because credit is involved in using a Mastercard Credit Card, you can use it to build a solid credit history for yourself. This is not true in case of debit cards.