Full Guide On How To Get An International Student Loan In Canada 2023

Full Guide On How To Get An International Student Loan In Canada 2023

If you’ve ever had reservations about studying in Canada as an international student due to the high cost of living, there are several options for financial help in Canada. Studying abroad may be costly. Because education is so important in society, industrialized countries provide outlets for students to get help. Even though education in Canada is less expensive than in the United States, overseas students still require specific support for their studies.

What are International Student Loans?

International Student Loans are private education loans made accessible by specialised lenders to international students studying at accredited colleges and universities in the United States or Canada. Generally, international students in the United States must apply with a qualified cosigner. However, there are an increasing number of universities in the United States and Canada where students can apply for a loan without a cosigner.

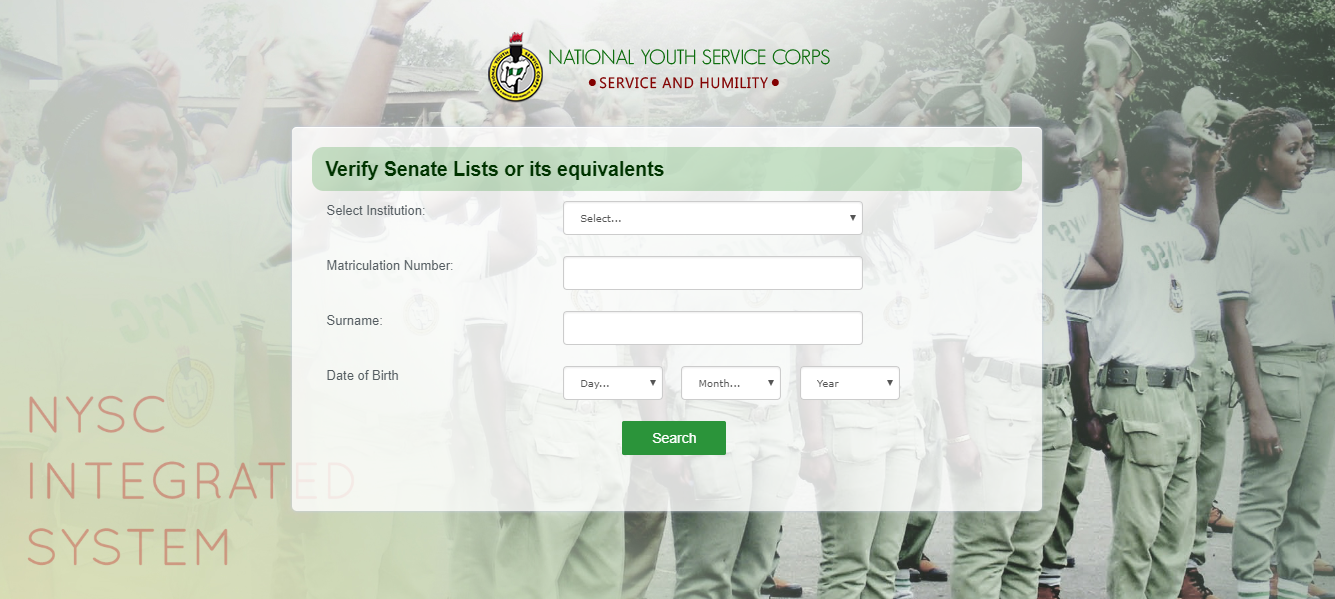

How can I apply for a Canadian foreign student loan?

Check to determine whether they are a good fit for your school and program. Complete your submission. Obtain a conditional bid after submitting your application. Upload the relevant papers and complete any further paperwork.

Do overseas students receive a loan for living expenses?

As a foreign student, you would be ineligible for a UK government home or EU student loan. There are, however, additional educational loans available that you may wish to investigate. If you wish to study full-time at a university in another country, you can apply for an International Enrolled Loan instead

How can I apply for a study loan in Canada?

You must apply through the student financial aid office in your province or territory of permanent residence. A single application would allow you to be considered for provincial student loans, Canada Student Loans, and the majority of Canada Student Grants. Every year, you must apply for funding.

Who may apply for an International Student Loan in Canada?

In their leisure time, students may explore the world’s second largest country, from dynamic cities to pristine wilderness. These international student loans may be available to you if you are an international student who want to study in Canada but requires financial support. Students who are neither Canadian citizens or permanent residents of a non-citizen nation and are enrolled in an approved Canadian institution or university are eligible to apply. International students in Canada (including students from the United States) can also apply for loans at specific universities.

What is the maximum amount that may be borrowed?

The entire cost of your education, less any additional help (such as scholarships, grants, and so on), is the maximum amount that can be borrowed. Furthermore, the overall cost of your education will vary based on your institution and the cost of attendance for the course. And, when you apply for and obtain first loan approval, your school must certify the loan amount.

How Do International Students Apply for Loans in Canada?

International students can obtain loans to help pay for their college education in Canada. It will be determined by your noncitizen status and if you have a co-signer. Here’s how to determine whether you’re eligible for a federal student loan, which private loans you’re eligible for, and how to shop for one.

How much money can you obtain for a student loan in Canada?

Part-time students are eligible for up to $10,000 in Canadian student loans. However, if you pay off part of the loans, you will be able to apply for more, up to the $10,000 maximum once again.

How can I apply for a Loan?

Here are a few steps to help you apply for an international student loan:

- You will need to know how much you need to borrow before applying for a private student loan. You should go through the financial assistance award letter you received from your school. Next, look for a loan that suits your requirements. You can accomplish this with a few clicks using our Loan Comparison Tool.

- You will then submit your application to the lender directly, and they will walk you through all of the necessary documentation. The money is paid straight to your school/university to pay your tuition when the lender receives and approves everything. Any residual loan proceeds will be paid to you.

Repayment Method

While payments will vary depending on the loan type you select, there is a 6-month grace period after graduation for federal Canada Student Loans. This means you won’t have to begin repaying your student loan until six months after graduation. International students in Canada are permitted to work while attending classes. Full-time students at a qualified institution with a study permit may work on campus without a work permit.

Conclusion

It is critical to analyze all factors, including how much scholarship money you have earned and how much financial assistance you will receive from your parents, guardians, and other close relatives.